How to Use a Loan Repayment Calculator to Budget for Your Caravan Purchase

Monday, June 3, 2024

Utilising a caravan loan repayment calculator is a pivotal step in planning for your caravan purchase. This handy tool helps you understand and manage your financial commitments by providing a clear picture of your potential monthly payments. In this article, we’ll explore the key features and benefits of a caravan loan repayment calculator, and why you should be using one on your journey to caravan ownership.

Why Use a Caravan Loan Calculator?

A caravan loan calculator simplifies the task of budgeting for a caravan by offering an estimate of your loan repayments. While these figures are not exact, they provide a useful ballpark that can help you gauge whether the financial commitment fits within your budget. The calculator allows for adjustments based on the loan amount, interest rate, repayment frequency, and term, giving you a comprehensive view of how these variables affect your monthly payments.

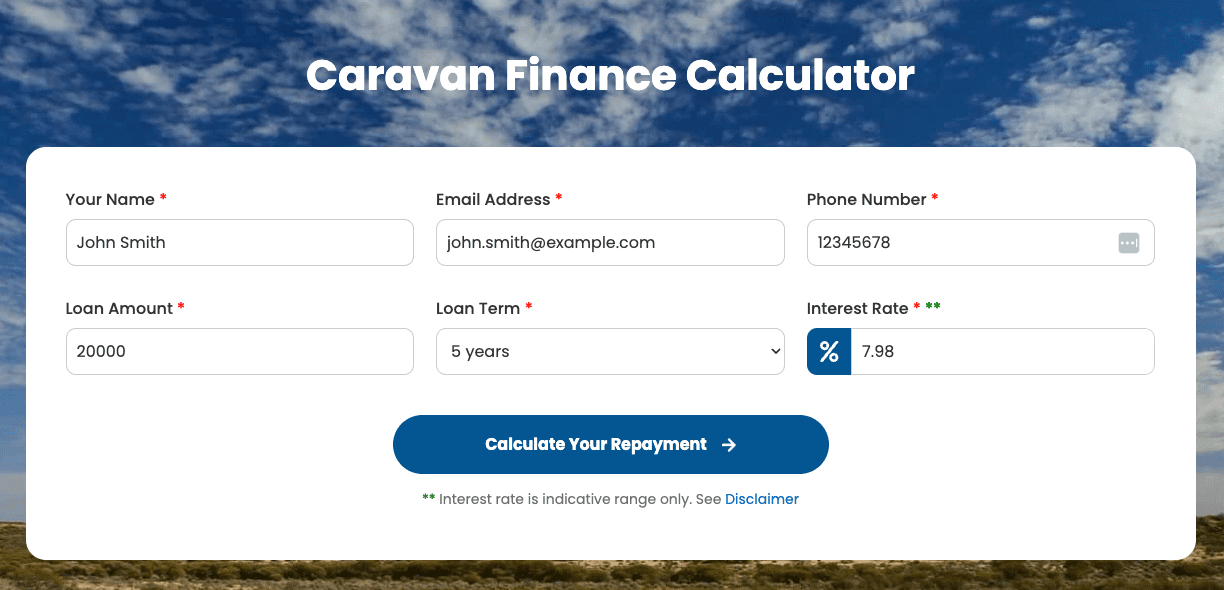

How to Effectively Use the Caravan Loan Calculator

To make the most of the caravan loan calculator, you will need several pieces of information ready

Loan Amount

The loan amount is essentially the principal that you plan to borrow for purchasing the caravan. This typically represents the price of the caravan minus any deposit that you might pay upfront. Adjusting the loan amount within the calculator allows you to see how increasing or decreasing the amount you borrow affects your monthly payments and overall financial obligation.

Interest Rate

The interest rate is a critical factor that significantly impacts your monthly loan payments. The rate can vary based on several factors, including your credit history and the type of loan you choose. It’s wise to use a conservative estimate within the calculator, ideally at the higher end of potential rates, to ensure you are prepared for the maximum possible repayment scenario. Our lending experts can provide more precise rate information once you discuss your specific circumstances.

Loan Term

The term of the loan refers to how long you have to pay back the loan. Adjusting the loan term in the calculator shows how the length of the loan affects your monthly repayments. Longer loan terms typically result in lower monthly payments but might increase the total amount of interest paid over the life of the loan. Exploring different loan terms can help you balance your monthly budget with the total cost of financing.

Repayment Frequency

Repayment frequency determines how often you make loan payments. Options typically include monthly, fortnightly, or weekly repayments. Changing the repayment frequency in the calculator helps you understand how often you need to make payments and how this scheduling aligns with your regular income and spending patterns, enabling better cash flow management.

Balloon Payment

A balloon payment is an option available in some loan agreements where you pay a large lump sum at the end of the loan period. Including a balloon payment in your loan structure can significantly reduce your regular repayment amount, but it requires you to plan for a large final payment. Adjusting for a balloon payment in the calculator allows you to see how it impacts your regular payments and assess whether you can feasibly manage the large sum at the end of your loan term.

Benefits of Using a Caravan Loan Repayment Calculator

Using a caravan loan repayment calculator offers several practical benefits. It provides clarity on the financial commitment involved in purchasing a caravan, helping you to plan your budget effectively. By allowing you to adjust various loan parameters, the calculator lets you compare different financing options and decide which one offers the best terms for your financial situation.

Furthermore, it enables you to customise the loan agreement to fit your financial stability, ensuring that your loan repayments are manageable within your budget.

Start Your Journey to Caravan Ownership with Credit One

A loan repayment calculator is an invaluable tool for anyone considering financing a caravan. By allowing you to simulate different borrowing scenarios, it helps you to make informed decisions about your loan and ensures that you select a financing option that comfortably fits within your budget. Before finalising any loan, it’s crucial to explore various scenarios using the calculator to find the optimal financing structure for your needs.

If you’re looking to buy a caravan, Credit One can help. With extensive access to lenders and a range of finance options, including secured caravan loans, commercial hire purchases and private sale loans, we offer a quick pathway to loan approval and a loan that fits your financial situation and needs.

If you’ve got your eye on a caravan and are wondering what it will cost to take the next big step, use our caravan loan calculator to set your loan term, loan amount, and interest rate, and find out just how affordable financing can be. And if you’re still wondering what to get, explore the range of caravans, motorhomes and camper trailers for sale at Only Vans and find your dream model today.