How to Find the Best Caravan Loan Deals in Australia

Wednesday, June 26, 2024

Dreaming of hitting the open road and exploring the vast Australian landscape in your own caravan? Whether you’re planning to traverse the rugged Outback, unwind on coastal escapes, or discover hidden gems in remote regions, finding the right caravan at the right price will set the stage for an unforgettable adventure.

But how do you find the best caravan loan deals in Australia? Whether you’re a seasoned traveller or a first-time buyer, securing the right financing ensures your journey starts on solid financial ground. In this blog, we’ll guide you through the essentials of finding competitive caravan loan deals, so you can make informed decisions for your next big adventure.

Research and Compare Loan Offers

The first step is to begin researching loan offers. While many lenders may operate nationally in Australia, it’s useful to consider local options in cities like Adelaide, Brisbane, Perth, Sydney, and Melbourne, as they may have tailored offers or promotions. Be sure to compare:

- Interest rates: Check both fixed and variable rates available.

- Loan terms: The length of the loan can affect your monthly payments and the total interest paid.

- Fees and charges: Make sure you ask about all associated costs, including establishment fees, ongoing account keeping fees, and any charges for early repayment. This last one is important if you decide to make extra payments to reduce the length of the loan.

Explore Different Caravan Loan Options

Caravan loans in Australia come in several forms, each with unique benefits and considerations.

Secured Caravan Loans

A secured caravan loan typically offers lower interest rates because the caravan itself serves as collateral for the loan. This security allows lenders to offer more competitive rates, which can significantly lower your monthly repayments. This makes a secured loan an appealing prospect for many buyers.

Unsecured Caravan Loans

Unlike a secured caravan loan, an unsecured loan does not require your caravan as collateral. This could be an ideal option if you do not want to tie your caravan to the loan. However, the interest rates for unsecured loans are generally higher due to the increased risk for the lender.

Fixed Interest Rate Loans

Opting for a fixed interest rate can provide predictability and ease in budgeting, as your loan repayments remain constant throughout the term of the loan.

Variable Interest Rate Loans

While variable rates can start lower than fixed rates, they can fluctuate with market changes, which could affect your repayment amounts over time.

Utilise Caravan Finance Calculators

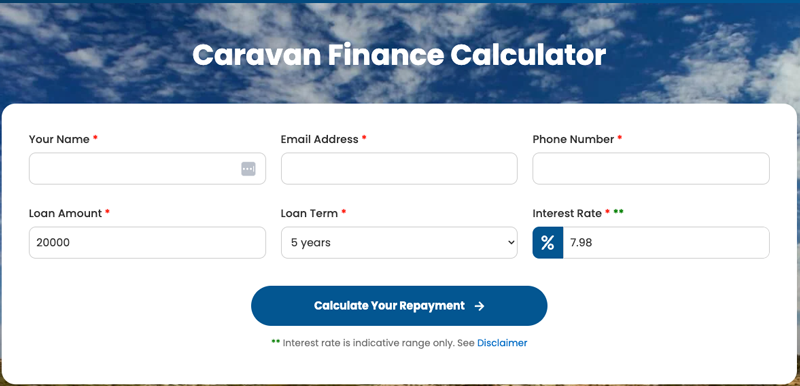

Caravan finance calculators are tools that help predict monthly payments and interest expenditures. You can input details like your desired loan amount, term, and interest rate to explore various scenarios. This step is helpful for initial financial planning in that it can give you a sense of what you may be able to afford. You should keep in mind that it’s only an estimate, however, and there are other factors that may come into play when you fill out the formal loan application.

Understand Fees and Loan Terms

It’s also helpful to review some of the most common fees and loan terms associated with a caravan loan. You will ultimately need to look beyond the headline interest rate and examine the fine print of your loan contract. Some fees and loan terms to look out for:

- Application and account-keeping fees: These can add up and affect the cost-effectiveness of a loan.

- Repayment flexibility: Some types of loans offer the ability to make extra payments or benefit from lower rates without penalty, providing significant long-term savings.

- Early repayment penalties: If you’re considering paying off your loan early, be aware of any penalties that might apply, such as an early termination fee.

Read Customer Reviews and Feedback

Customer testimonials and reviews for lenders can give you a glimpse into what your experience with them might be after your caravan purchase. Look for comments on their reliability, customer support, and of course the overall ratings from people who have used their services. Be sure to review feedback in your city, since it’s possible that lender practices might vary regionally.

Consult with Finance Brokers

A finance broker can greatly simplify the process of finding the best caravan loan and help you get a better deal. Brokers have access to a wide range of loan options and can tailor their search to find the best deal for your specific needs and financial situation. They can also simplify the application process, provide expert advice, and negotiate terms on your behalf, potentially saving you time and money. This guidance can make the entire caravan financing experience smoother and more efficient.

Take your Time and Prepare for Each Step of the Process

We know it’s difficult when you’re already dreaming of hitting the open road, but patience will pay off in helping you secure the best caravan loan. Using tools like caravan finance calculators and seeking advice from finance brokers can help you make an informed decision. But even after that, don’t rush into a purchase that you’re at all uncertain about. Make sure you secure a financing deal that aligns with your needs and long-term goals so that your caravan adventure will be more enjoyable and stress-free.

Start Your Journey to Caravan Ownership With Credit One

If you’re looking to buy a caravan, Credit One can help. Contact our team now. With extensive access to lenders and a range of finance options, including secured caravan loans, commercial hire purchases and private sale loans, we offer a quick pathway to loan approval and a loan that fits your financial situation and needs.

If you’ve got your eye on a caravan and are wondering what it will cost to take the next big step, use our caravan loan calculator to set your loan term, loan amount, and interest rate, and find out just how affordable financing can be. And if you’re still wondering what to get, explore the range of caravans, motorhomes and camper trailers for sale at Only Vans and find your dream model today.